Economy

Trump’s 2025 Tariffs on India Explained: Full List, Dates, Products, and 50% Duty Impact

Economy

Is India Really a ‘Dead Economy’? A Deep Dive Into the Facts Trump Didn’t Mention

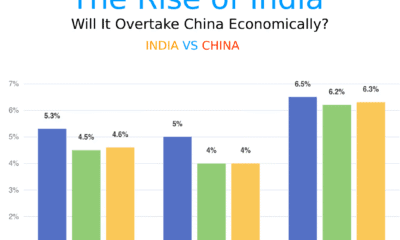

When Donald Trump recently called India a “dead economy,” it sparked global headlines and trended across social media. For many, this bold remark raised questions — is there any truth to it? Is India really falling behind, or is something else happening beneath the surface?

Economy

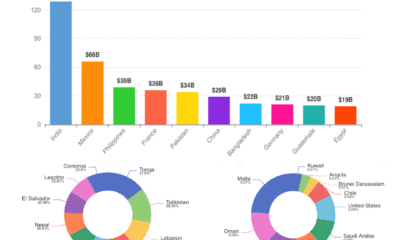

India’s Top Exports and Imports in 2023: What the World Buys and Sells with India

References

- Niti.gov.in. (2022). India Climate & Energy Dashboard. [online] Available at: https://iced.niti.gov.in/economy-and-demography/key-economic-indicators/gdp.

- Wikipedia. Tariffs in the Second Trump Administration. Available at: https://en.wikipedia.org/wiki/Tariffs_in_the_second_Trump_administration

- Times of India. India-US trade deal: Trump announces 25% tariff on India. Available at: https://timesofindia.indiatimes.com/business/india-business/india-us-trade-deal-trump-announces-25-tariff-on-india-plus-penalty-for-buying-energy-and-arms-from-russia/articleshow/122998698.cms

- Reuters. Trump imposes extra 25% tariff on Indian goods. Available at: https://www.reuters.com/world/india/trump-imposes-extra-25-tariff-indian-goods-ties-hit-new-low-2025-08-06/

- IndiaTimes. Donald Trump’s India tariffs set to hit US shoppers hard. Available at: https://indiatimes.com/trending/donald-trumps-india-tariffs-set-to-hit-us-shoppers-hard-phones-auto-parts-jeans-jewellery-to-get-costlier-665564.html

- Al Jazeera. Trump imposes 25 percent tariff on Indian goods over Russian oil. Available at: https://www.aljazeera.com/news/2025/8/6/trump-imposes-25-percent-tariff-on-indian-goods-over-russian-oil

- Economic Times. India reacts to 50% US tariffs. Available at: https://economictimes.indiatimes.com/news/economy/foreign-trade/trump-tariff-from-50-on-india-and-brazil-to-35-on-canada-heres-how-nations-stack-up-in-comparison/articleshow/123145315.cms

- Khandekar, N. (2025). India to remain fastest growing major eco with 6.5% growth in FY26: IMF. [online] The Economic Times. Available at: https://economictimes.indiatimes.com/news/economy/indicators/india-to-remain-fastest-growing-major-eco-with-6-5-growth-in-fy26-imf/articleshow/118649360.cms.

- World Bank (2023). Population, Total. [online] The World Bank. Available at: https://data.worldbank.org/indicator/SP.POP.TOTL.

- CIA (2024). Median age – The World Factbook. [online] www.cia.gov. Available at: https://www.cia.gov/the-world-factbook/field/median-age/country-comparison/.

- UN Comtrade. (2024). Available at: https://comtrade.un.org [Accessed 25 Jul. 2025].

- ITC Trade Map. (2024). Available at: https://www.trademap.org [Accessed 22 Jul. 2025].

Technology2 years ago

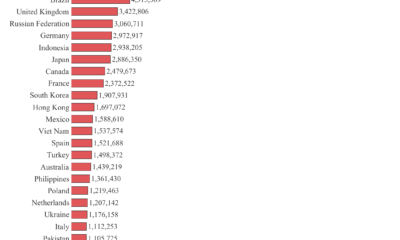

Technology2 years agoHighest number of software developers by country in the world 2023 by GitHub | Data Player

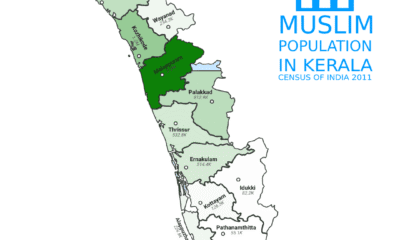

Religion2 years ago

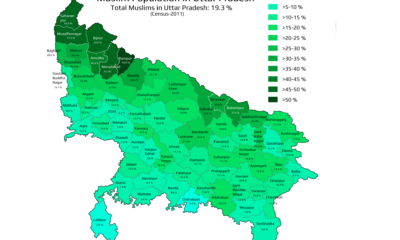

Religion2 years agoMapped: What are the muslims population in Uttar Pradesh | State of India

Economy3 years ago

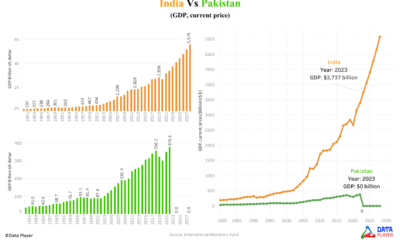

Economy3 years agoWhy Pakistan’s economy is drowning while India’s economy is touching the sky

Demographics2 years ago

Demographics2 years agoMapped: Average Working Hours by European Countries in 2024

Religion2 years ago

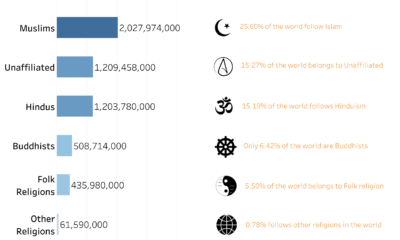

Religion2 years agoWorld’s Largest Religion in 2024 | Data Player

Religion2 years ago

Religion2 years agoMapped: What is Muslim Population in West Bengal by District wise 2011

Demographics3 years ago

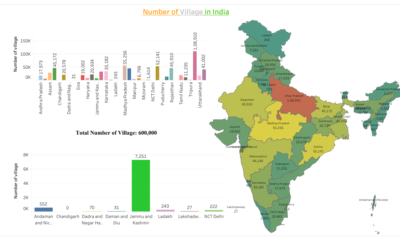

Demographics3 years agoWhat are the Number of Villages in India by its State and Union Territory

Demographics3 years ago

Demographics3 years agoMassive population size by Indian states 2023